Fundamentals Underpinning Rural Property Values In Australia Remain “Rock Solid

DEMAND for quality agricultural land continues to outstrip availability, driving an upwards trend on prices across Australia, according to a recent Rabobank report. The financial institution’s inaugural Australian Land Price Outlook, titled No Summit in Sight — Ag Land Prices to Climb Higher, was released at the end of August.

The report’s author, Rabobank agricultural analyst Wes Lefroy said agricultural land prices were set to continue to climb over the next two years, although the overall rate of price growth was predicted to slow — impacted by weakening economic ‘tailwinds’ and current adverse seasonal conditions in some parts of Australia. “While agricultural land prices are influenced by macro-economic factors, Australian land markets are highly regionalised,” he said

The common factor has been that, across most agricultural regions, demand for quality land continues to outstrip market availability. “This is the driving force behind land prices continuing to move higher and we consider this demand/ availability imbalance to be the overarching driver as to why land prices will continue to increase over the next two years, albeit at a lower level of growth with a decrease of support from macro-economic fundamentals,” Mr Lefroy said.

By the end of 2017, the report found, the median price for agricultural land in Australia had risen to A$2278 per hectare, at a compound annual growth rate (CAGR) of 2.5 per cent over 10 years. Strongest growth had been shown in Tasmania, Victoria and Western Australia respectively. Much of the growth in prices paid for farming land had been driven by rises in farmers’ operating profits, Mr Lefroy said, supported by positive macro-economic conditions for the agricultural sector.

“Nationally, the five-year (2013-17) average reported farm operating profit in 2017 was just under seven times larger than a decade earlier (for 2003-07),” he said. “And this growth has primarily come from broadacre cropping and mixed livestock farms.” A further factor contributing to price growth had been market interest from corporate buyers. “Corporate interest in ag land has also increased, adding competition for farmland purchases,” he said.

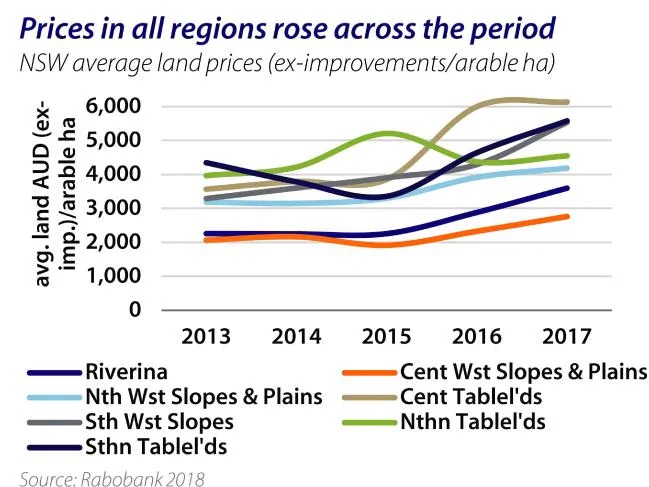

Australian Land Price Outlook report 2018: New South Wales average land price. Picture: Rabobank

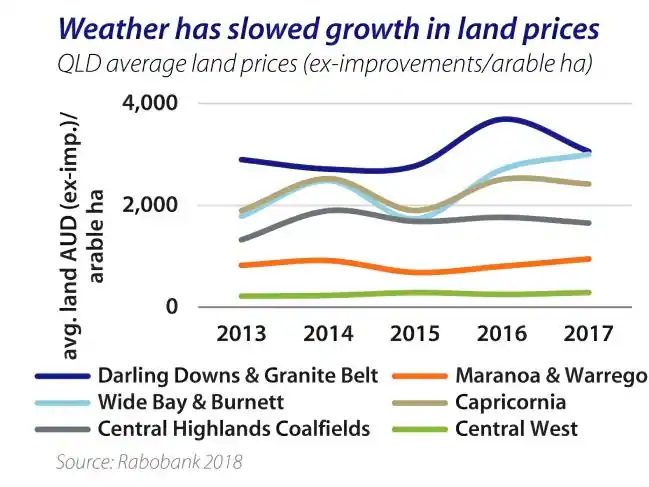

QUEENSLAND and New South Wales continue to demonstrate market influences driven by drought and dry conditions. In NSW, all agricultural areas showed land price increases across the period from 2015-17, however, the report saw that this growth would soften, with the current dry impacting operating costs. This would slow demand for land purchases. However, high cropping and beef profits, and “intense competition for tightly held land will continue to push prices higher”. In Queensland, beef prices have continued to support land prices, as has strong interest in quality arable land.

Australian Land Price Outlook report 2018: Queensland average land price. Picture: Rabobank

Rural Weekly spoke with several rural property specialists across the state to gauge a sense of regional markets. James Croft is principal/ director of Ray White Rural, Pittsworth, on the Darling Downs. Mr Croft said the drought was not having a large impact on land prices, with rural producers largely able to absorb the costs of a poor winter crop. “As time goes on, and if there’s no summer crop and a low supply of water, that’s where you could see confidence do a downward trend,” Mr Croft said. Several recent sales in the region have reflected a continued interest in quality irrigation and dryland properties. “Our prime Darling Downs farming country hasn’t gone down in value. We’ve done some record deals in the last three to six months,” he said.

He cited one recent sale of a blue-chip irrigation property that had fetched $9000 per acre, and a dryland operation that had come in at $4300/acre. Mr Croft said prices in his region were being maintained by competition for quality land and high commodity prices, with the primary property investment being driven by family-based agribusinesses.

He said corporate interest in land still influenced price growth, although there had been a tapering of interest over the past six months, while interest from Chinese agricultural companies had tapered in the past 12—18 months. This perception was also the experience of Darryl Langton, rural property specialist with Landmark Harcourts Roma, servicing the Maranoa, Warrego and Western Downs regions. He said that, particularly in the eastern parts of his region, a below average winter was offset by good rainfall over the preceding summer. Good pasture and water reserves were making the region attractive to buyers out of northern and central NSW and western Queensland.

“It’s added buyers into our marketing campaigns from areas where we normally receive some inquiry, but it’s certainly increased the volume of inquiry,” Mr Langton said. “Our market has been in a strong upwards cycle here since 2014, and the market continues to gather momentum.” Small through to large family-based agribusiness looking to aggregate with neighbouring properties also continued to be strong players in the regional agricultural property market.

A minor element in the local market had been some investment in mulga land by players in the carbon market. The Wide Bay Burnett was shown in the Rabobank report to be indicating a strong upwards trend. Baden Lowrie, rural properties specialist with Elders Rural Bundaberg said a strong driver of growth in the Bundaberg agricultural property market had been around the development of macadamia as a significantly growing horticultural sector in the region. “The key focus in the last 18 months to two years has been suitable larger parcels of land for macadamia development,” Mr Lowrie said. “With the lower sugar prices, there’s not too many parties interested in sugar cane properties for sugar cane production, but they are looking at suitable soil types, and larger scale areas with irrigation supply for macadamias.” He estimated that 90 per cent of sugar cane farms recently sold have been transitioned to macadamia production. Investment in this sector was coming from both family and corporate agribusinesses. Mr Lowrie works across an area extending north to Biloela and west to Eidsvold, and saw a similar pattern to other rural property specialists in terms of investment in grazing properties, with competition strong for quality pasture land with water, as people looked to create additional or regionally diverse grazing options.

RABOBANK report author Wes Lefroy said nationally, growth in land prices would likely weaken. “Looking forward, we do expect the tailwinds from macro-economic fundamentals that have supported the growth of land prices to weaken,” Mr Lefroy said. “The cost of funding for banks is expected to rise so this would decrease the relative borrowing capacity for farmers. “In addition, a fall in production across some major agricultural commodities, following a number of high-production years, will impact operating profits, particularly with the current dry conditions in eastern Australia.”